Financial Report Analysis Template

Try and customize this Trustees & Finance Co. financial report analysis template.

100% customizable templates

Millions of photos, icons, charts and graphics

AI-powered editing features

Effortlessly share, download, embed and publish

Easily generate QR codes for your designs

- Design stylemodern

- Colorslight

- SizeLetter (8.5 x 11 in)

- File typePNG, PDF, PowerPoint

- Planbusiness

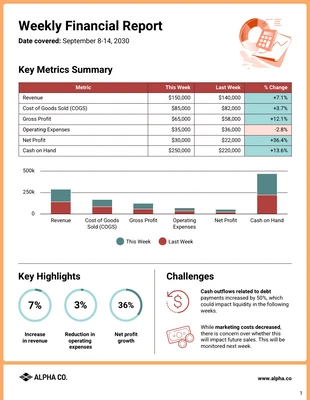

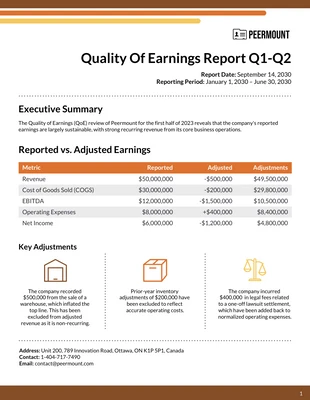

A financial report analysis is a document that provides information on the financial health of a company. It includes data on the company's income, expenses, and cash flow. The report also provides an analysis of the company's financial position and performance over time. A financial report is an important tool for investors, creditors, and other interested parties to assess the financial health of a company. The report can help them make informed decisions about whether to invest in or lend to the company. A financial report analysis includes several key components: The first thing you’ll need to include is the income statement. This shows a company's revenues and expenses over a period of time. It can be used to assess profitability and trends in income and expenses. The balance sheet shows a company's assets, liabilities, and equity at a specific point in time. It can be used to assess financial stability and solvency. A financial report analysis also includes statements of cash flows. This shows a company's cash inflows and outflows over a period of time. It can be used to assess liquidity and cash