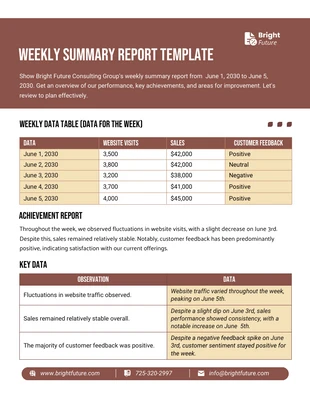

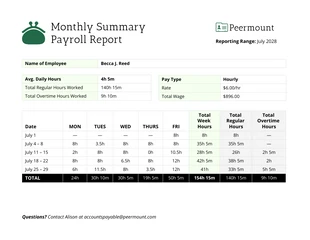

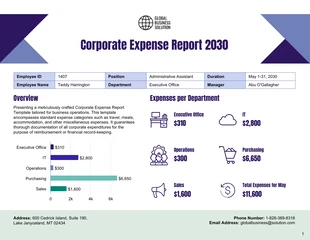

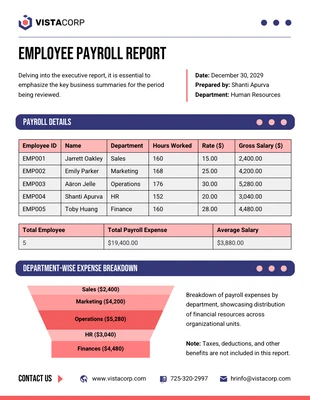

Sample Payroll Summary Report Template

Make an informative payroll summary report by editing Venngage payroll summary report template.

100% customizable templates

Millions of photos, icons, charts and graphics

AI-powered editing features

Effortlessly share, download, embed and publish

Easily generate QR codes for your designs

- Design stylemodern

- Colorslight

- SizeLetter (8.5 x 11 in)

- File typePNG, PDF, PowerPoint

- Planbusiness

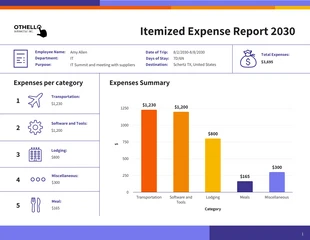

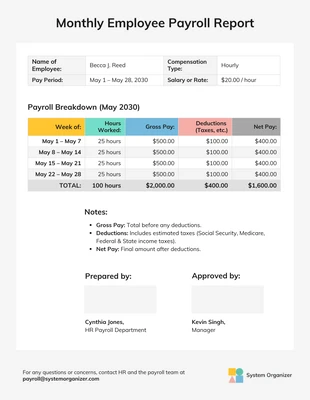

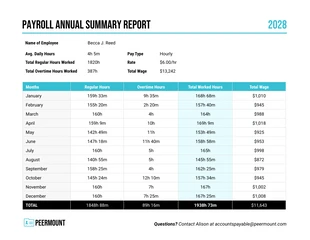

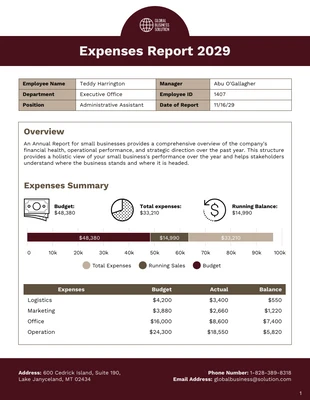

A payroll summary report is a document that summarizes an employee's pay and deductions for a pay period. The report includes relevant information such as the employee's name, gross pay, taxes withheld, and net pay. This information can be helpful for both employees and employers alike. For employees, a payroll summary report can help them keep track of their earnings and deductions. This information can be useful when it comes time to file taxes or make other financial decisions. Employers can also use these reports to track employee compensation and compliance with tax laws. Payroll summary reports typically contain the following information: - Employee name and contact information - Gross pay (total earnings before deductions) - Taxes withheld - Net pay (total earnings after deductions) - Deductions (e.g. 401k, health insurance, etc.) This information can be presented in a variety of formats, but most payroll summary reports will include all of the aforementioned information. Some employers may choose to provide additional details such as year-to-date earnings or vacation accrual. At its core, a payroll summary is a simple document that can be used to track